ABOUT NET LEASE HOLDINGS

![]()

| Investing in Real Estate | ||

While it is possible to build an investment portfolio limited to the more traditional asset classes such as stocks, bonds and cash, we believe that allocating a portion of an investor's assets to real estate is important for diversification and portfolio risk management. Equally important, real estate may provide a steady stream of income and the potential for capital appreciation depending on the investment approach and asset capitalizationfstructure chosen. |

||

| Net Lease Holdings (NLH) | ||

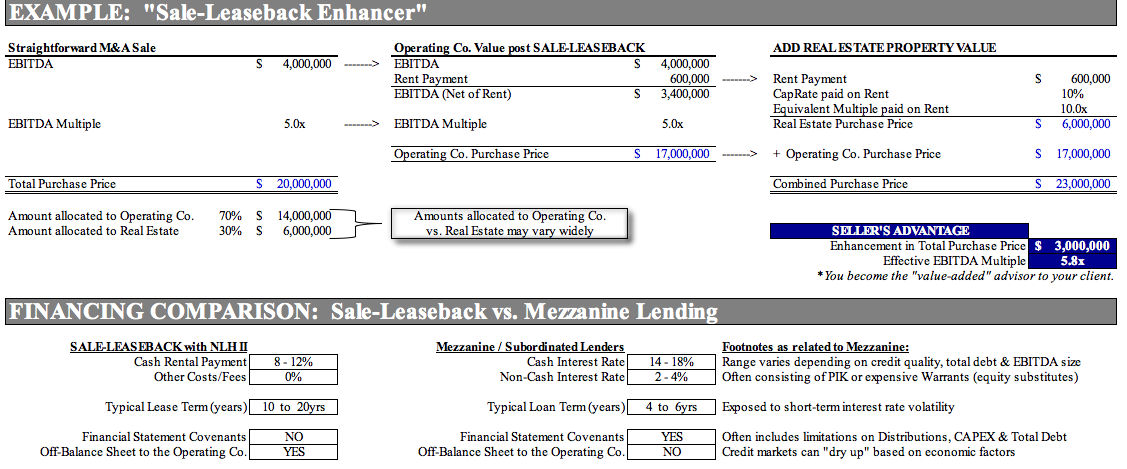

NLH is neither a broker nor an intermediary. NLH is the buyer/owner. NLH Principals invest a significant amount of their own capital alongside our equity investors and we will pay referral fees for qualified property acquisitions that enter our portfolio. NLH manages and monitors each real estate investment from acquisition to disposition. Active communciation and reporting of the portfolios performance is distributed in a timely and transparent manner. NLH helps companies convert an otherwise depreciating and under-utilized asset into working capital they can use to pay down debt, fund acquisitions, buyout a minority shareholder or reinvest in the core competencies of their business. The NLH Principals have worked together for more than 17 years and have over 50 years of combined experience structuring commercial and industrial real estate transactions. |

||

| Typical Business Relationships | ||

| NLH's referral sources are typically corporations, private equity groups, turnaround firms, real estate and business brokers, investment banks, commercial banks, accounting and law firms. We have worked with a variety of industries and credit situations and have an experienced bench of structuring professionals that can dovetail our funding into any capital structure. | ||

HELPFUL LINKS FOR |